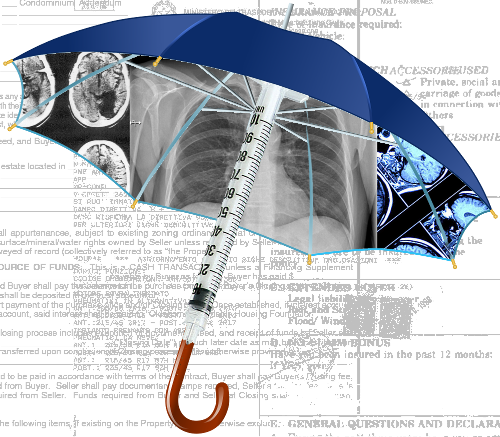

High costs for insured cancer

New figures show patients with private health insurance are paying almost twice as much in out-of-pocket expenses for cancer treatment.

New figures show patients with private health insurance are paying almost twice as much in out-of-pocket expenses for cancer treatment.

Researchers from the University of Western Australia have followed adults with colorectal, lung, prostate or breast cancer over the course of 3 years, monitoring their demographic, financial, and treatment information, including all costs during treatment.

Participants living in outer metropolitan areas experienced higher costs than participants in rural areas. Ninety-eight per cent of outer metropolitan and 95 per cent of rural participants were out-of-pocket - the amounts they paid varied between $13 and $106,140.

The majority of participants’ out-of-pocket costs were due to gap payments for medical costs such as surgery, tests and doctor’s appointments.

Among rural participants, mean out-of-pocket expenses were higher for men, for people with private health insurance, and for people who were married, had undergone surgery, or had worked prior to being diagnosed with cancer, report the authors, led by Professor Christobel Saunders.

Among outer metropolitan participants, mean out-of-pocket expenses were higher for men, for people with private health insurance, and for those who had undergone surgery, worked prior to being diagnosed with cancer, resided in higher socioeconomic areas, or were receiving chemotherapy.

“The higher out-of-pocket expenses for people with private health insurance or undergoing surgery indicate the importance of health care funding arrangements and the magnitude of the costs borne by patients,” Prof Saunders and colleagues wrote.

“The marked variation in out-of-pocket expenses … highlights the need for easily accessible information about services, medical costs, and gap payments for all health care services.

“Problems that still need attention in the unregulated private fee-setting environment in Australia include price discrimination in some specialist sectors.

“Bundles of care for cancer treatment that would allow patients and their families to better understand and plan for expenses should be explored,” they concluded.

Print

Print