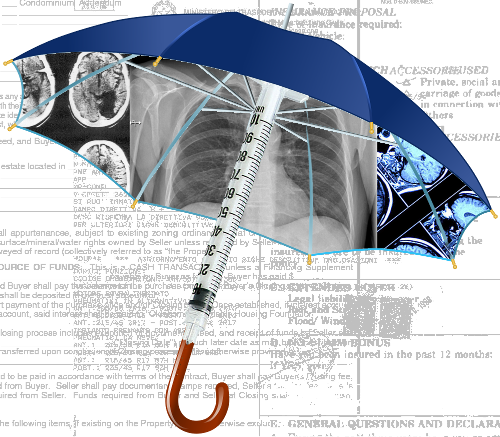

Insurance costs keep rising

A new report shows the cost of private health insurance is rising, but so are the exceptions.

A new report shows the cost of private health insurance is rising, but so are the exceptions.

For the first time, the majority of hospital treatment policies held by Australians now contain exclusions, the latest ACCC annual report into the private health insurance industry has found.

More than 57 per cent of policies now contain exclusions, up from about 44 per cent last year.

“Many people may not be aware their policies may have exclusions and don’t realise they would not be covered at all for treatment as a private patient for those conditions,” ACCC Deputy Chair Delia Rickard said.

“We’ve been working with private health insurers about how they can better communicate such detrimental policy changes to consumers.

“Insurers need to make sure these changes are communicated clearly, prominently and in a timely manner, to avoid misleading consumers,” Ms Rickard said.

While the rate of increase in average annual premiums has slowed over the past five years, average premiums have still increased by more than inflation and wage growth over the year.

This has led to a growing wave of young consumers in particular dropping out of private health insurance.

The ACCC has also identified an emerging and potential risk of consumer harm from the collection and use of consumer data by health insurers and others in the health sector.

“Several health insurers offer rewards schemes for their members, some of which include the use of tracking apps to record physical activity. Such information may in some cases be combined with other external data sources to profile consumers for targeted marketing,” Ms Rickard said.

“While Australian consumers can benefit from these programs, we are concerned that few consumers may be fully informed or fully understand the scope of data collected when they sign up for, or use, such services.”

Print

Print